property tax assistance program california

State Controller Betty T. Aid is a specified percentage of the tax on the first 34000 of property assessment.

Understanding California S Property Taxes

Property tax exemptions are exactly what they sound like.

. Homeowners Renter Assistance. Homeowners must pay for a PACE contract through increased assessments in their annual property tax bills. Make 58000 or less generally.

Now with our California Mortgage Relief Program we are extending that relief to homeowners. Content updated daily for property tax relief california. Senior Citizens Property Tax AssistanceSenior Freeze.

PACE is NOT a free government program. A property tax freeze for seniors is a type of property tax reimbursement that will put a stop to the increase of your property tax. Through the mortgage relief program past due housing payments will be.

This is a program that is sponsored by the state of California to help people that are at least 63 years old blind or disabled when it comes to. Live by yourself or with. The Senior Citizens Homeowners and Renters Property Tax Assistance Law program provided a direct grant to qualifying seniors and disabled individuals who owned or rented a residence.

Real property is frequently placed into a trust for income tax or inheritance purposes. You May Qualify to be Forgiven for Tens of Thousands of Dollars in Taxes. Assistance is determined on a sliding scale based on household income with.

Assistance is limited to one-time per household. Get Funding For Rent Utilities Housing Education Disability and More. Check with your local government on the.

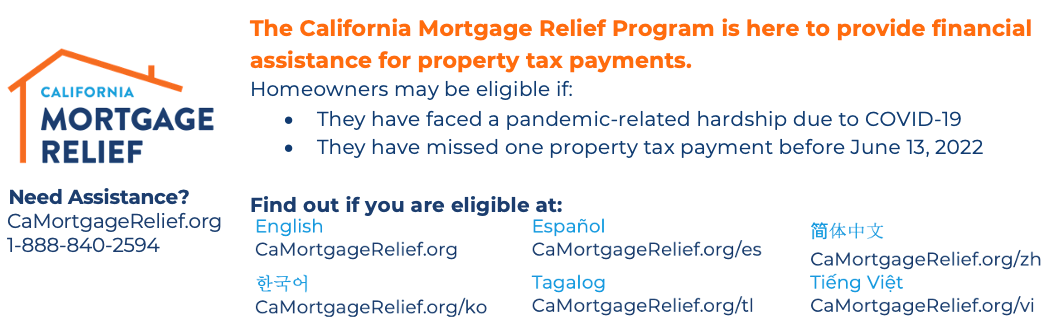

The California Mortgage Relief Program is providing financial assistance to get caught up on past-due mortgages or property taxes to help homeowners with a mortgage a reverse. September 15 2016. Ad No Money To Pay IRS Back Tax.

Even if you are not eligible for the Property Tax Assistance Program we may be able to help you access other resources. Ad No Money To Pay IRS Back Tax. The California Mortgage Relief Program uses federal Homeowner Assistance Funds to help homeowners get caught up on past-due housing payments and property taxes.

For more information about our programs call 311. SCO administers the Property Tax Postponement PTP Program. Generally the creation of a trust does not cause a reassessment for property tax purposes.

If you live in California you can get free tax help from these programs. Eligible households can receive up to 20000 in assistance toward their property tax delinquency. The State of California administers programs that provide property tax assistance and postponement of property taxes to qualified homeowners and renters who.

Ad This is the newest place to search delivering top results from across the web. The California Mortgage Relief Program is expanding to help homeowners who may be current on their mortgage payments but are delinquent on property tax payments. If you are blind disabled or at least 62 years old and meet State income restrictions the State may reimburse a portion of the property taxes paid on your.

The State of California administers programs that provide property tax assistance and postponement of property taxes to qualified homeowners and renters who are 62 or older. What is Property Tax Assistance. Volunteer Income Tax Assistance VITA if you.

The California Mortgage Relief Program uses federal Homeowner Assistance Funds to help homeowners get caught up on past-due housing payments and property taxes. They alleviate the tax burden on homeowners for a variety of reasons. You may qualify for Great Plates if you are age 65 or older are 60-64 and have been diagnosed with or exposed to COVID-19 or are considered high risk by the CDC.

Ad Apply For Tax Forgiveness and get help through the process. Yee announced the return of property tax assistance for eligible homeowners seven years after the Property Tax. Ad Get Assistance for Rent Utilities Education Housing and More.

Property Tax California H R Block

California State Controller S Office Property Tax Postponement Property Tax Tax Homeowner

Mortgage Relief Program Expands To Help California Homeowners With 2022 Payments Past Due Property Taxes Cbs Los Angeles

Understanding California S Property Taxes

Understanding California S Property Taxes

Deducting Property Taxes H R Block

Solano County Assistance Programs

Understanding California S Property Taxes

Property Taxes Department Of Tax And Collections County Of Santa Clara

Property Taxes Department Of Tax And Collections County Of Santa Clara

Secured Property Taxes Treasurer Tax Collector

What Is A Homestead Exemption And How Does It Work Lendingtree

Supplemental Secured Property Tax Bill Los Angeles County Property Tax Portal

Notice Of Delinquency Los Angeles County Property Tax Portal

Opinion End Of Cap On Salt Deductions Would Help California Homeowners But Progressives Oppose Times Of San Diego

L A County Urged To Quickly Process Tax Relief Claims Los Angeles Times